A Low Risk Passive Income Investment with a Relatively Higher Return

The ILS Note Sales program allows accredited investors to acquire a 90% interest in a performing real estate note without taking on the responsibility of servicing the note themselves. For individual investors, LLCs, partnerships, trusts, and IRAs seeking low-risk passive income, this investment strategy can deliver a healthy return on investment over a given period of time. Investors seeking a passive investment solution with relatively low risk and a higher return will enjoy the simplicity of this private money notes for sale program.

Private Money Notes For Sale

The available Notes vary in geographic location and loan structure allowing an opportunity to build a diversified portfolio. Note values range from $25K to over $7MM with a variety of timeframes and payment schedules. Interest rates start at 6.999%.

An investor can purchase a 90% interest in a single performing Note by investing 90% of the Unpaid Principal Balance (UPB) plus a one-time pre-Note fee of $200. When selling real estate notes, ILS Capital retains a 10% interest to maintain some “skin in the game” proving our commitment to our investors and our confidence in our offering.

From that point forward, interest is split according to ownership percentage and then paid to investors monthly following each monthly payment made by the underlying borrower.

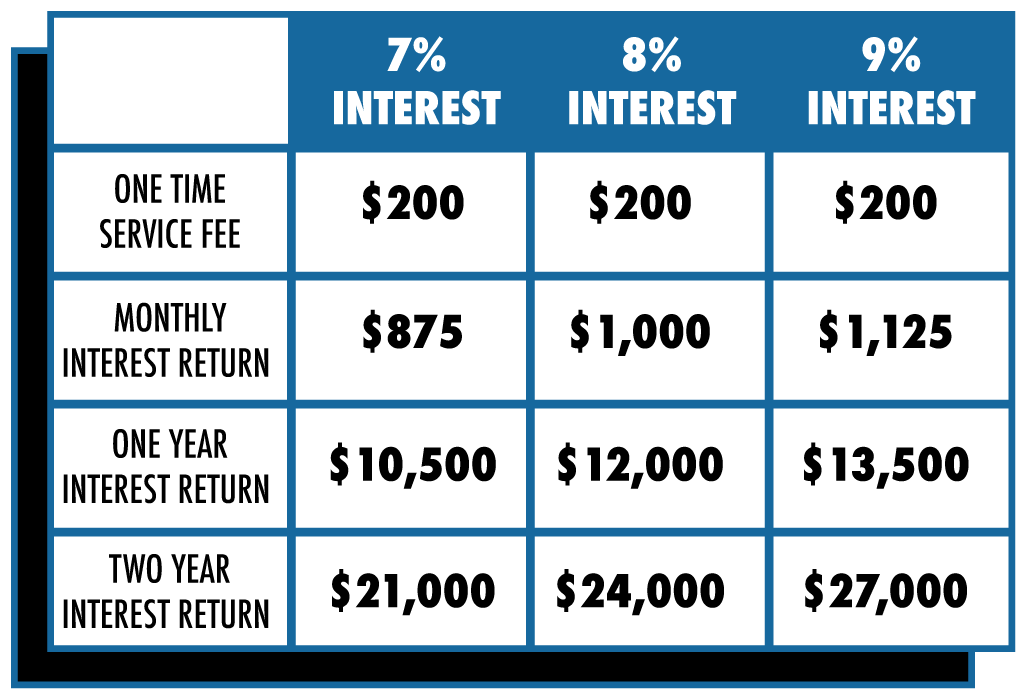

For example, if we sell a note for $150,000, the investor could potentially see the following returns depending on the interest rates:

How To Get Started

- ILS Capital maintains an inventory of currently available Notes for sale.

- Upon execution of a confidentiality agreement, you can view our inventory of available Real Estate Notes and select one or more that best match your investment goals.

- Once you have provided a letter of accreditation and other required information and documents, the transaction documents will be prepared and executed, and the transaction will be funded.

That’s it! Simple and Efficient. We will facilitate the document preparation, recording, and the monthly servicing of the Note. You can sit back, relax, and watch the monthly payments roll in.

Unmatched Services. Unmatched Excellence.

ILS Note Sales

Invest in Established Real Estate Notes

Note Value: $25K - $7MM+

Interest Rate: Starting at 6.999%

Minimum Investment Amount: 90% of Unpaid Principal Balance (UPB)

Ownership Interest: 90%

Service Fee: $200 per Note (one time)

Distributions: Monthly

Investment Timeframe: Depends on individual Note purchased