Our loans consistently show solid performance because we have complete control over all terms and loan components. By using private capital to fund our lending operations, we can adjust as need to market demands and assure we’re making good deals in any market environment. All this without the involvement of a bank, wall street, or other influences. This complete control enables us to be flexible with many factors that go into structuring a loan.

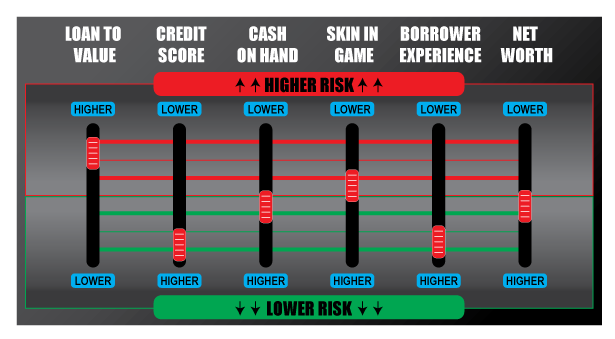

We can introduce more risk at times and lower risk as needed by dialing loan terms up or down. Similar to the way an audio equalizer works, we can mix all the individual components of a loan to get the perfect end result.

- Loan To Value (LTV)- higher LTV increases risk, lower LTV lowers risk

- Credit score- higher Credit Score requirements lowers the risk, reducing requirements increases risk

- Cash On Hand- higher cash requirements lowers the risk, lowering requirements results in higher risk

- Other loan structuring parameters work in a similar way. Increasing skin in the game, borrower experience, or net worth required will all lower the risk.

Many other factors can be used in this way to raise and lower risk. These include Asset Type, Asset Value, Market, Sub-Market and others. All this flexibility, combined with our proven lending team of professionals and procedures is what has enabled us to show solid financial results from our Real Estate lending operations and the related good results our investors have experienced.

Learn more about Investor Loan Source: http://www.ils.cash